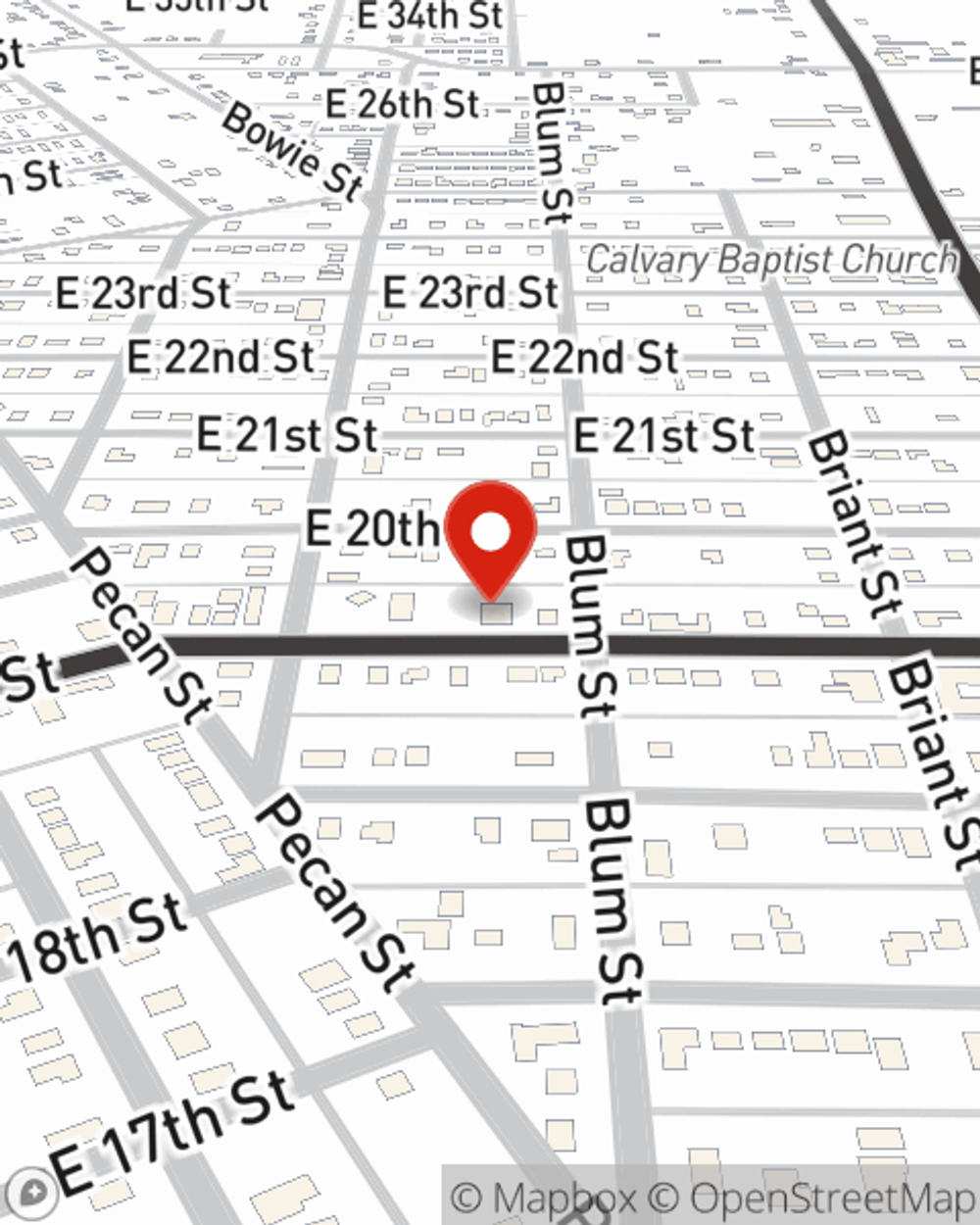

Business Insurance in and around San Angelo

Calling all small business owners of San Angelo!

This small business insurance is not risky

Business Insurance At A Great Value!

Running a business can be risky. It's always better to be prepared for the unfortunate mishap, like a customer stumbling and falling on your business's property.

Calling all small business owners of San Angelo!

This small business insurance is not risky

Protect Your Future With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Lynn Johnson is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such considerate service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Lynn Johnson can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let concerns about your business stress you out! Contact State Farm agent Lynn Johnson today, and explore how you can meet your needs with State Farm small business insurance.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Lynn Johnson

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.